Insurance Coverage for Short-term Vacation Rentals

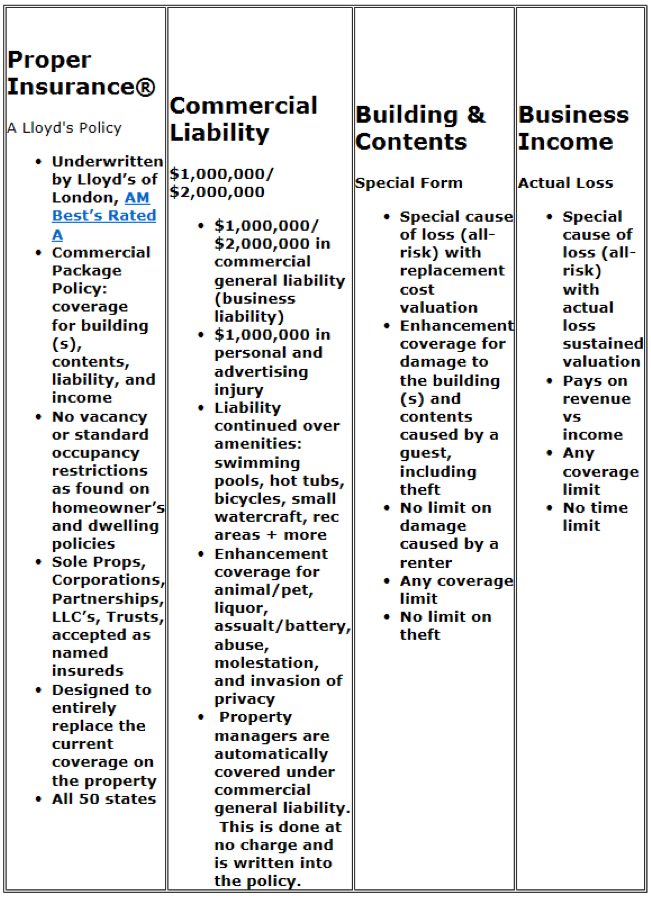

The Proper Insurance® policy replaces your homeowner’s and dwelling fire policy. Custom-penned for the unique risks of vacation rental and/or short-term rental properties.

Insured by Lloyds of London with a special policy for short-term vacation rental properties. Vacation homes – townhomes – duplexes – condos – cabins – apartments + more

This program can be used with all vacation property; managed by owner, property managers or vacation rental booking sites such as Airbnb, Booking.com, Flipkey, HomeAway, TripAdvisor, Vacation Rental.com, VRBO.

Please feel free to contact us at 800-637-5088 or vacationrentalins@insurit.com to discuss further.

Property Managers

It’s so very important for your owners to carry the correct insurance on their vacation rental properties and provide you as additional insured automatically with this policy. This policy has the some of broadest coverages available.

FAQ

What is considered short-term renting?

In the insurance world, a property that is rented for less than 30 days at a time is typically considered short-term. A property in which the renter does not reside/live at the dwelling. Many home insurance carriers have denied coverage if short-term renting was not disclosed by the insured, see Emily Richer Vs Travelers Insurance – July 2017

Who pays the claims?

Insurance is a three party transaction. There is the insured (you), the insurance agency, and the insurance company (underwriter). The insurance company pays the claims. The Proper policy is underwritten by Lloyd’s of London which is AM Best’s rated A. Lloyd’s has an excellent reputation for claims paid and is considered premier in the industry. They are the founding company of insurance over 325 years ago

Why does my homeowner’s policy not cover my short-term rental?

All homeowner’s policies carry a “business activity exclusion”. In other words, any claim involving a “business activity” could rightfully be denied

I have a landlord policy and have been told this covers my short-term rental, is this correct?

Landlord policies also carry a “business activity” exclusion. Landlord policies are written for landlords, not business owners. A long-term lease rental is not a business. Let’s use a liability example: A renter leases your home for six months. Two months later he/she “slips and falls” in the shower because there is soap scum built up on the tub floor. Does this liability fall on the landlord? No, of course not, it’s the tenant’s responsibility to keep a clean tub. Now, the same situation. A vacationer rents a home for a week. You better believe it’s the property owner’s responsibility to keep a clean tub. The vacationer assumed they were renting a clean/safe property. No different than a hotel. The liability falls on the property/business owner.

How do I get covered for business activity?

You buy a business insurance policy. The Proper Insurance policy is a business policy. It covers your business property (rental home/contents), business liability, and the business income it generates

My short-term rental is also my primary residence; can I still purchase the Proper Policy?

Yes. If the short-term rental home is also your primary residence, Proper simply adds $1,000,000 in personal liability and $50,000 in loss of use to relocate in the event the property is being rebuilt.

What if I also live at the short-term rental, can I still purchase the Proper policy?

Yes. You have the same business exposure. We see every scenario imaginable. You live upstairs and short-term rent the downstairs. You live in the main home and rent out the guest house, etc

If I have the Proper policy do I keep my homeowner’s or landlord policy in place?

No. The Proper policy is designed to fully replace the current coverage you have. You would cancel your current policy.

Does the Proper policy cover vacation rental condos and homes?

Yes. The Proper policy covers single family homes, condos, duplexes, town homes, and more. It does not require to be defined as a vacation rental/short-term rental etc.

What is personal liability?

Personal liability is found on homeowner’s policies. It covers you for personal negligence and follows you anywhere you go in the world. It’s very important to carry personal liability. This is why Proper adds it to our policy in the event your short-term rental doubles as your primary residence.

Does my personal umbrella covers over my short-term rental?

No. The same “business activity” exclusions apply as it’s personal. However, standard personal umbrellas do cover over a long-term landlord property. It’s not a business.

What is a commercial umbrella?

A commercial umbrella is a policy that covers “above and beyond” standard business policies liability limits. Since the Proper policy is a business policy and carries $1,000,000/$2,000,000 in commercial general liability, it does suffice as the underlying policy for a commercial umbrella. We sell commercial umbrellas. Contact us to get pricing and information

I have my short-term rental under a Corp is this OK?

Yes it is ok. Since your short-term rental is a business we can write your policy with the named insured as an individual, partnership, LLC, Corp, or Trust.

Why don’t all the major insurance carriers offer a policy for short-term rental properties?

Most insurance companies see short-term rental properties as “high risk”. Lots of foot traffic and unknown variables. They simply don’t want to take on the risk. The Proper policy, Lloyd’s of London understands the risk and is willing to insure it. Note: Lloyd’s of London has been underwriting insurance for over 325 years?

Do you offer flood, earth quake and hurricane Coverage?

Yes we write flood, earth quake and hurricaneinsurance.

Do you have more questions?

We believe in education first. We want to answer any and all the questions you have. Please Contact Us by Email, or call 800-637-5088. We look forward to working with you!

Commercial umbrella

A commercial umbrella is a policy that covers “above and beyond” standard business policies liability limits. Since the Proper policy is a business policy and carries $1,000,000/$2,000,000 in commercial general liability, it does suffice as the underlying policy for a commercial umbrella. We sell commercial umbrellas. Contact us to get pricing and information

Earth Quake

Earthquake insurance is a form of property insurance that pays the policyholder in the event of an earthquake that causes damage to the property. Most home and business insurance policies do not cover earthquake damage. Rates vary depending on your location.

Contact us to get pricing and information

Flood

Flood insurance covers direct physical losses caused by floods are covered. Also covered are losses resulting from flood-related erosion caused by strong, abnormally high waves or currents of water activity, severe storm, flash flood or abnormal tidal surge. Damage caused by mudslides as specifically defined in the policy forms is covered

Contact us to get pricing and information

Liability

Property managers are automatically covered under commercial general liability. This is done at no charge and is written into the policy.

Please feel free to contact us at 800-637-5088 or vacationrentalins@insurit.com to discuss further.